dallas texas sales tax rate 2020

Click here to get more information. Sales Tax The sales tax rate in Dallas is 825 percent of taxable goods or services sold within c ity limits.

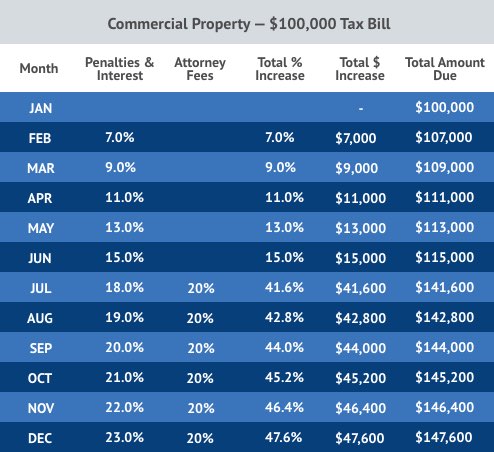

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Dallas Co 2057217.

. There is no applicable county tax. The minimum combined 2022 sales tax rate for Dallas Texas is. AddisonDallas Co 2057217 010000 082500 Allentown 067500 DallasMTA 3057994 010000 AngelinaCo 4003007 005000 AdkinsBexar Co 082500 Alleyton 067500.

Terminate or Reinstate a Business. 2022 Texas state sales tax. Local Sales Tax Rate Information Report.

You can pay your property taxes via the dallas county tax office website or renew your vehicle registration via. Dallas TX 75202 Telephone. Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate.

DALLAS CNTY COMMUNITY COLLEGE. Exact tax amount may vary for different items. 2022 Tax Rates Estimated 2021 Tax Rates.

214 653-7888 Se Habla Español. Download and further analyze current and historic data using the Texas Open Data Center. 27129 Estimated MortgageTax minimize 336.

If you do business in any of these unique city areas you must use the combined area local code instead of the regular city and countyspecial purpose district codes to report local sales and use tax. This is the total of state county and city sales tax rates. Sales Tax Permit Application.

Average Sales Tax With Local. Looking for Dallas County Election Information or Results. Wayfair Inc affect Texas.

This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. Texas Income Tax Calculator - SmartAsset Corrections and Clarifications 1156 AM on Sep 16 2020 CDT. The Texas sales tax rate is currently.

Tax Office Past Tax Rates. The December 2020 total local sales tax rate was also 8250. Texas has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 2.

You can print a 825 sales tax table here. For tax rates in other cities see Georgia sales taxes by city and county. The Dallas Texas sales tax is 625 the same as the Texas state sales tax.

With local taxes the total sales tax rate is between 6250 and 8250. There is no applicable city tax or special tax. 214 653-7811 Fax.

Dallas is in the following zip codes. The 7 sales tax rate in Dallas consists of 4 Georgia state sales tax and 3 Paulding County sales tax. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

The state sales tax rate in Texas is 6250. It is a 585800 Acres Lot in ROCHESTER PARK. Texas has recent rate changes Thu Jul 01 2021.

This table shows the total sales tax rates for all cities and towns in Dallas County. TEXAS SALES AND USE TAX RATES April 2022. 104 rows Downtown Administration Records Building 500 Elm Street Suite 3300 Dallas TX 75202 Telephone.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The County sales tax rate is. If you have questions about Local Sales and Use Tax rates or boundary information email TaxallocRevAcctcpatexasgov or call 800-531-5441 ext.

Select the Texas city from the list of popular cities below to see its current sales tax rate. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. There are a total of 981 local tax jurisdictions across the state collecting an average local tax of 1681.

Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. What is the sales tax rate in Dallas Texas.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. You can print a 7 sales tax table here. City sales and use tax codes and rates.

75201 75202 75203. Simplify Texas sales tax compliance. The sales tax rate for these counties is 0 however the Dallas and Dallas MTA sales tax rates are 1 and 1 respectively meaning that the minimum sales tax you will have to pay in these four counties and the city of Dallas when combined with the base rate of.

While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. Real Estate for Sale. Texas Sales Tax Table at 625 - Prices from 100 to 4780.

Did South Dakota v. 1 lower than the maximum sales tax in GA. The December 2020 total local sales tax rate was also 6250.

For tax rates in other cities see Texas sales taxes by city and county. 2901 DORRIS St Dallas TX 75215 is listed for sale for 77500. 214 653-7888 Se Habla Español.

Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes. The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. 214 653-7811 Fax.

Dallas County TX Sales Tax Rate The current total local sales tax rate in Dallas County TX is 6250. The rates shown are for each jurisdiction and do not represent the total rate in the area. Beginning in FY 2020-21 the Texas Property Tax Reform and Transparency Act of 2019 SB 2 caps the Citys ability to grow property tax revenue at 35 percent without seeking.

The Dallas sales tax rate is. Taxes Home Texas Taxes. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process.

Texas Comptroller of Public Accounts.

Tax Information City Of Sachse Official Website

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

2021 2022 Tax Information Euless Tx

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Texas Sales Tax Small Business Guide Truic

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Taxes Don T Have To Be Scary I Can Sell Your House And Save You Money At The Same Time Send Me A Message To G Tax Deductions Selling House Selling Your

Federal Estate Tax Rate Schedule Dallas Business Income Tax Services

Texas Sales Tax Guide For Businesses

Sales Tax On Grocery Items Taxjar

Texas Sales Tax Guide And Calculator 2022 Taxjar

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

What Is The Dallas Texas Sales Tax Rate The Base Rate In Texas Is 6 25

Tax Rates Richardson Economic Development Partnership

Texas Sales Tax Rates By City County 2022

What Is The Dallas Texas Sales Tax Rate The Base Rate In Texas Is 6 25

10210 Strait Ln Dallas Tx 75229 Photo View Photos Stairwell Home Values

Mattress Sets Clearance Prices Mattress Sale Cheap Mattress Sets Dallas Mattress Sales Cheap Mattress Sets Mattress Sets